Ripple also challenges SEC’s use of ‘deliberative process privilege’ to prevent agency documents on Bitcoin, Ethereum and XRP from disclosure.

The U.S. Securities and Exchange Commission and Ripple Labs continue to fight tooth and nail over the SEC’s internal documents in the SEC v. Ripple Labs lawsuit, with the SEC shielding the documents citing deliberative process privilege (DPP) and Ripple seeking to bolster its “fair notice” defense.

In a letter to U.S. Magistrate Judge Sarah Netburn this week, defense attorneys representing Ripple, its CEO Brad Garlinghouse and executive chairman Chris Larsen challenged the SEC’s blanket use of DPP, which protects certain internal government agency information such as recommendations and analyses involved in a government decision or policy, from disclosure during litigation.

Citing the recent deposition of former SEC director William Hinman, Ripple’s attorneys argued that his testimony and the SEC’s internal documents would “fatally undermine the SEC’s allegations that the Individual Defendants acted recklessly in failing to recognize Ripple’s sales of XRP as an unregistered securities offering as at that time, securities law experts of Mr. Hinman’s stature (to say nothing of the full Commission) had not reached that conclusion themselves, despite looking into the issue.”

Hinman’s personal views on XRP ‘dubious’

According to Ripple’s defense attorneys, Hinman had, during his recent deposition, “admitted that prior to him joining the SEC in 2017 — but years into the alleged unregistered securities offering by Ripple — the application of the federal securities laws to digital assets was ‘new for everyone’ and ‘no one knew a whole lot.’”

The SEC “repeatedly mischaracterizes the deposition testimony from Mr. Hinman and Ripple’s counsel’s motion to strike non-responsive testimony,” wrote Ripple’s defense attorneys in a footnote, referring to the SEC’s assertion in its Aug. 17 letter to Netburn that Ripple had moved to strike on the record Hinman’s testimony that he met with Ripple representatives and told them that he considered Ripple’s sales of XRP to be sales of securities and that Ripple should stop its unregistered sales.

“Mr. Hinman’s personal views as to XRP’s status are dubious, in any event, given his testimony that not all of the factors laid out in Howey need to be met to be an investment contract,” wrote Ripple’s defense attorneys, adding that “Hinman’s testimony is refuted by the SEC’s own communications to the public, as late as October 2020, that the SEC had made no determination as to XRP’s status.”

The Howey test is used to determine whether a financial product should legally be deemed a security. Under the Howey Test, an investment contract “exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

Why the internal documents matter

The SEC, which filed its lawsuit against Ripple in December 2020, has alleged that Ripple’s sale of XRP was an unregistered securities offering worth more than US$1.38 billion. The SEC also named Ripple’s CEO Brad Garlinghouse and executive chairman Chris Larsen as co-defendants for allegedly aiding and abetting Ripple’s violations.

At the heart of the lawsuit is whether transactions involving XRP constitute “investment contracts” and therefore securities subject to registration under Section 5 of the Securities Act of 1933. The outcome of the SEC’s lawsuit against Ripple and determination of XRP’s status is being closely watched by crypto companies and investors alike for its potentially far-reaching implications for the cryptocurrency industry. The SEC, which previously asserted that it had no legal duty to explain the XRP’s legal status to others, has sought to dismiss one of Ripple’s core arguments — that the SEC failed to provide “fair notice” that XRP transactions violated the law or that the SEC would later claim XRP itself to be an investment contract.

In May, Judge Netburn, who is overseeing discovery for this case, ordered the SEC to reveal internal agency documents, memoranda or formal position papers that discussed Bitcoin, Ethereum and XRP, subject to a privilege assertion. “Examples of such documents include Division reports, final reports of internal working groups, or formal position papers submitted to the Commissioners,” the judge ruled. “Although such documents may ultimately be privileged, information that would be provided on a privilege log, such as dates and participants, may itself be relevant and discoverable.”

Netburn’s May ruling was a clarification to her April 6 ruling where she granted “in large part” Ripple’s motion to compel the SEC to produce documents reflecting SEC’s prior statements and communications with third parties as well as internal documents discussing whether XRP, Bitcoin or Ether are considered securities. “The discovery related to Bitcoin and Ether is relevant,” said Netburn in April. “I think it is relevant to the Court’s eventual analysis with respect to the Howey factors, but I also think it is relevant as to the objective review of defendants’ understanding in thinking about the aiding and abetting charge or aiding and abetting count. I also think it is relevant to the fair notice defense that Ripple is raising.”

DPP is ‘a critical governmental privilege’

However, the SEC has argued that its internal communications were irrelevant to Ripple’s fair notice defense and to the SEC’s aiding and abetting claims against Garlinghouse and Larsen. “The DPP is a critical governmental privilege designed to promote the quality of agency decisions by preserving and encouraging candid discussion between officials,” wrote SEC attorney Jorge Tenreiro. “The Court should not override that privilege and punish frank governmental deliberations, particularly where the internal predecisional, deliberative material Defendants seek, which they never saw or knew about, is not relevant to any claim or defense.”

In their latest letter, Ripple’s attorneys asserted that the SEC had ignored the court’s prior rulings. “The SEC’s awareness of market uncertainty about whether or how digital assets were regulated by U.S. securities laws and the SEC’s own uncertainty about whether or how the U.S. securities laws apply to digital assets are all relevant evidence of whether market participants were on reasonable notice of what the law required,” Ripple’s defense attorneys wrote. “The fact that the SEC failed to communicate its views publicly only further strengthens the relevance of the material in question.”

“Defendants have maintained since the onset of this litigation that to the extent the SEC possesses documents evidencing its own uncertainty or confusion around the regulation of digital assets it should produce those documents — the stakes are simply too high to operate on less than a full record, particularly when individual liability is at stake,” Ripple’s defense attorneys added.

James Filan, a defense lawyer and former federal prosecutor who frequently comments on developments in the SEC v. Ripple lawsuit, said in a tweet: “Judge ordered documents produced ‘subject to a privilege assertion’ and said ‘documents withheld on the basis of privilege must be identified on a privilege log.’ The SEC submitted privilege logs claiming EVERYTHING is privileged and Ripple is ‘calling B.S.’”

Discovery deadlines looming

This dispute is the latest battle between the SEC and Ripple as the deadlines for fact discovery and expert discovery — due to be completed by Aug. 31 and Oct. 15 respectively — draw close.

The SEC and Ripple are currently also fighting over the SEC’s demand for Ripple’s employee Slack communications and Ripple’s bid to permanently redact portions of the SEC’s letter to Netburn seeking an order for Ripple to produce its relevant Slack messages.

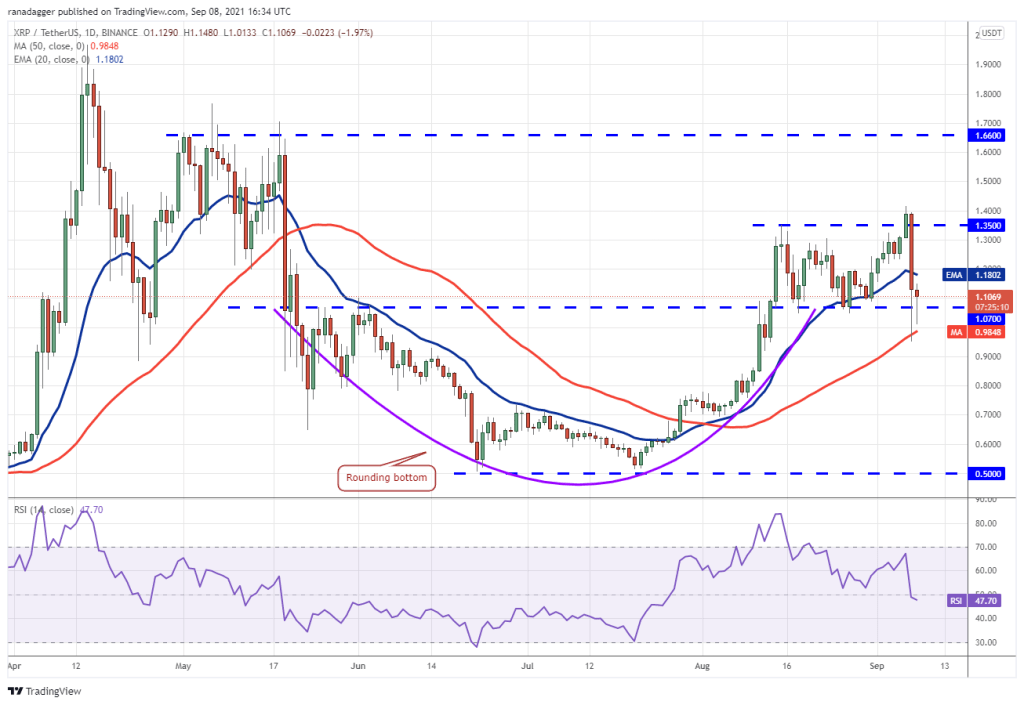

XRP was trading at US$1.25 as of publishing time, according to CoinGecko data, about 5% in the past week.